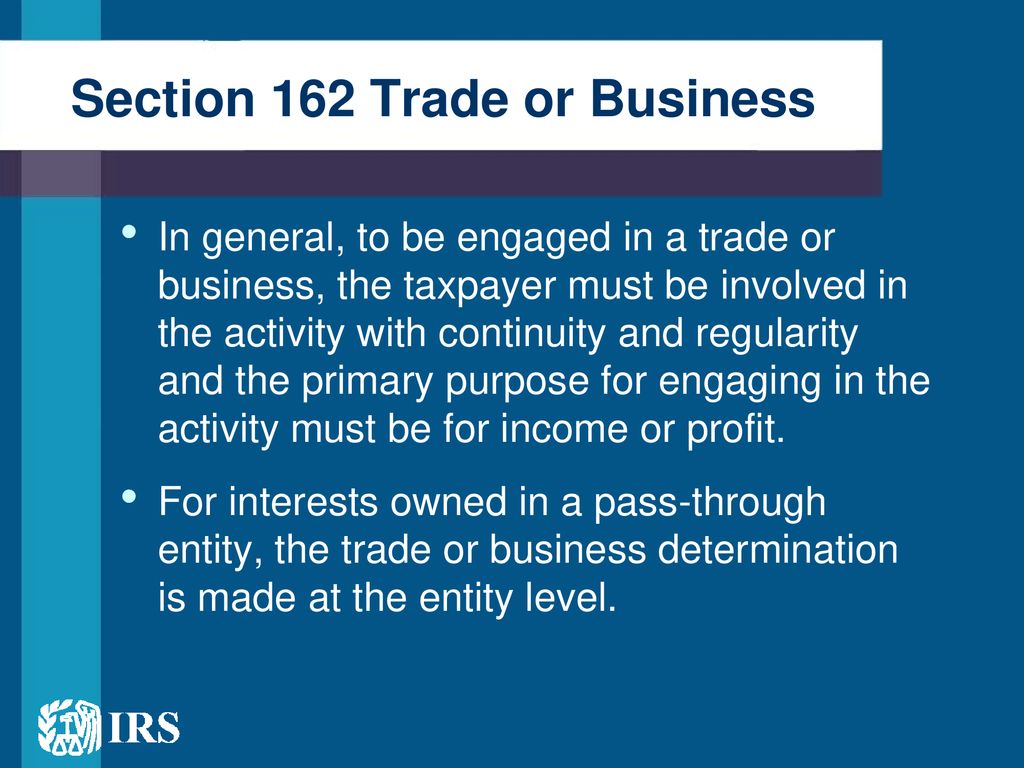

Substantiating Business Expenses in Audits – Step Two: Proving a “Trade or Business” Incurred the Business Expenses | Wagner Tax Law

Limit on Deductions for Executive Compensation at Public Companies - QuickRead | News for the Financial Consulting ProfessionalQuickRead | News for the Financial Consulting Professional

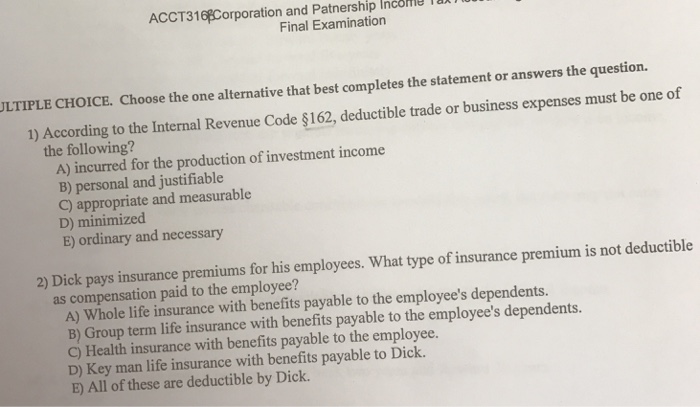

Part I Section 162.--Trade or Business Expenses 26 CFR 1.162-1: Business Expenses. (Also §§ 801, 831) Rev. Rul. 2008-8 ISSUES

Payments of membership dues are deductible for most members of a trade association under Section 162 of the Internal Revenue Cod

Amazon.com: Maximizing Section 199A Deductions: How Pass-through Entity Owners and Real Estate Investors Can Annually Save Thousands in Income Taxes: 9781697192292: Nelson, Stephen L: Books

Column: Preller, Padres finding out 162 games is a rugged test for a contender - The San Diego Union-Tribune

Fillable Online taxpayeradvocate irs Trade or Business Expenses Under IRC 162(a) - taxpayeradvocate irs Fax Email Print - pdfFiller

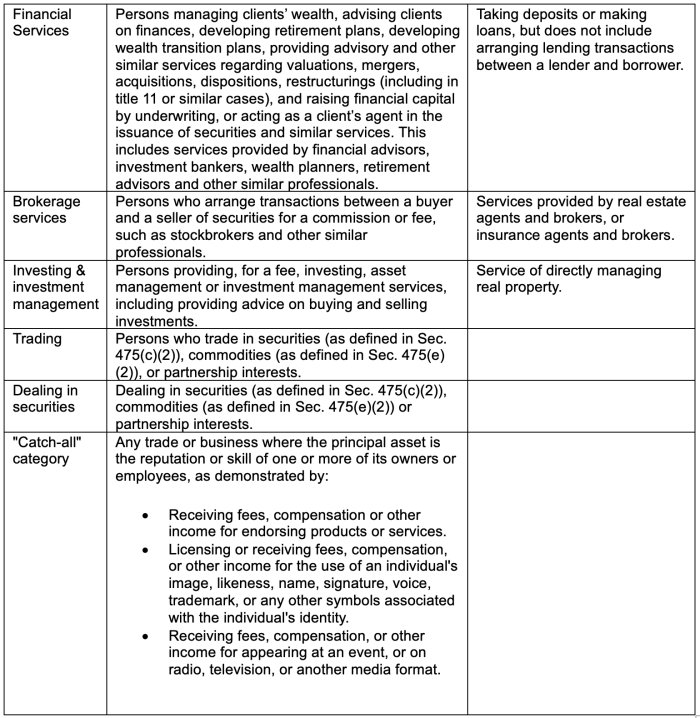

GreenTraderTax Comments on Section 475 Clean Up Project Copyright @ 2015 GreenTraderTax.com 1 Comments on IRS Section 475 Clean

Part I Section 162.--Trade or Business Expenses 26 CFR 1.162-1: Business expenses. (Also §§ 263, 263A; 1.263(a)-1) Rev. Rul.